Explain briefly the factors which affect the. It will produce results in the future.

:max_bytes(150000):strip_icc()/dotdash_Final_An_Introduction_to_Capital_Budgeting_Sep_2020-05-d479e099d1744e149a7690ab744900da.jpg)

An Introduction To Capital Budgeting

This preview shows page 2 - 4 out of 4 pages.

What is capital budget proposal evaluation. Capital budgeting differs from expense budgeting because it focuses on long-term investments and not immediate expenses. Critically examine the various methods of evaluation of capital Budgeting proposals. Capital budgeting is the process of analyzing and ranking proposed projects to determine which ones are deserving of an investment.

Investment is forward-looking in nature. Plan and budget the determination of cash out-flows and cash-inflows over a long period of time. Capital budgeting is the process by which investors determine the value of a potential investment project.

Capital budgeting is the pr ocess that companies use for decision making on capital projects projects with a life of a year or more. An all-inclusive capital budget covers the entire property and serves as a means to evaluate its physical condition pinpoint existing and anticipated needs determine upkeepmodernization costs and find ways to address these needs within financial limits. Of new products.

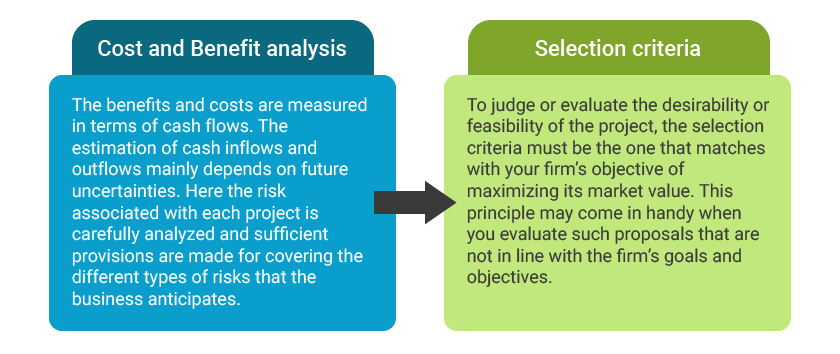

Capital budgeting is the process of determining which long-term capital investments a company will make in order to profit in the long-term. That is why he has to value a project in terms of cost and benefit. It is the process of deciding whether or not to invest in a particular project as all the investment possibilities may not be rewarding.

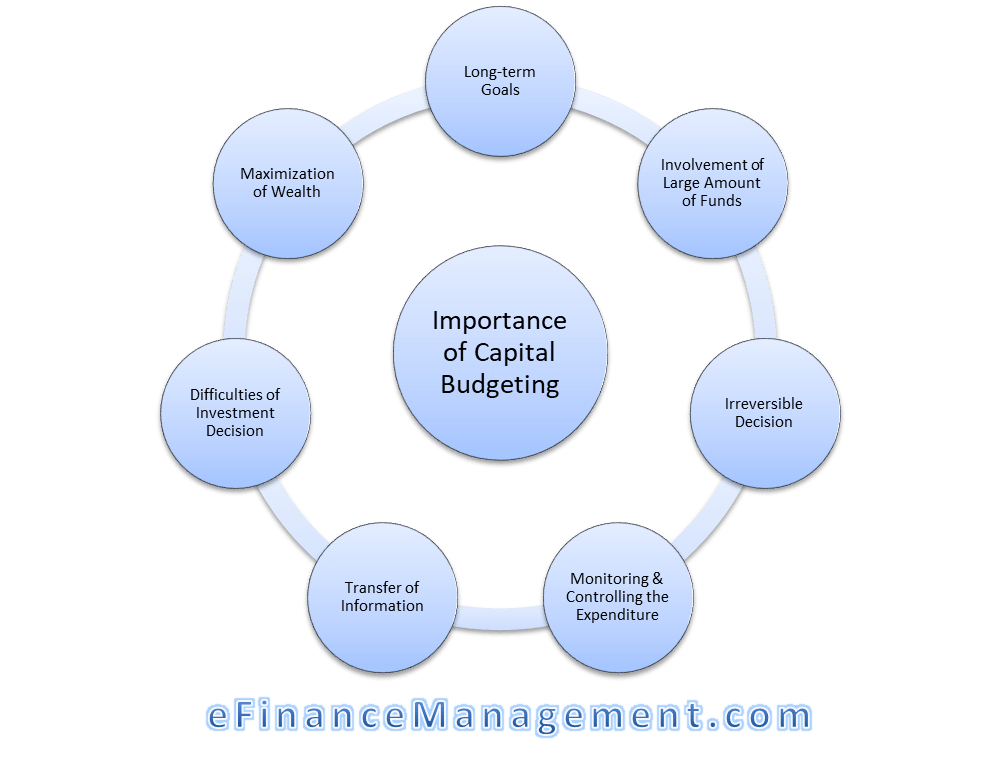

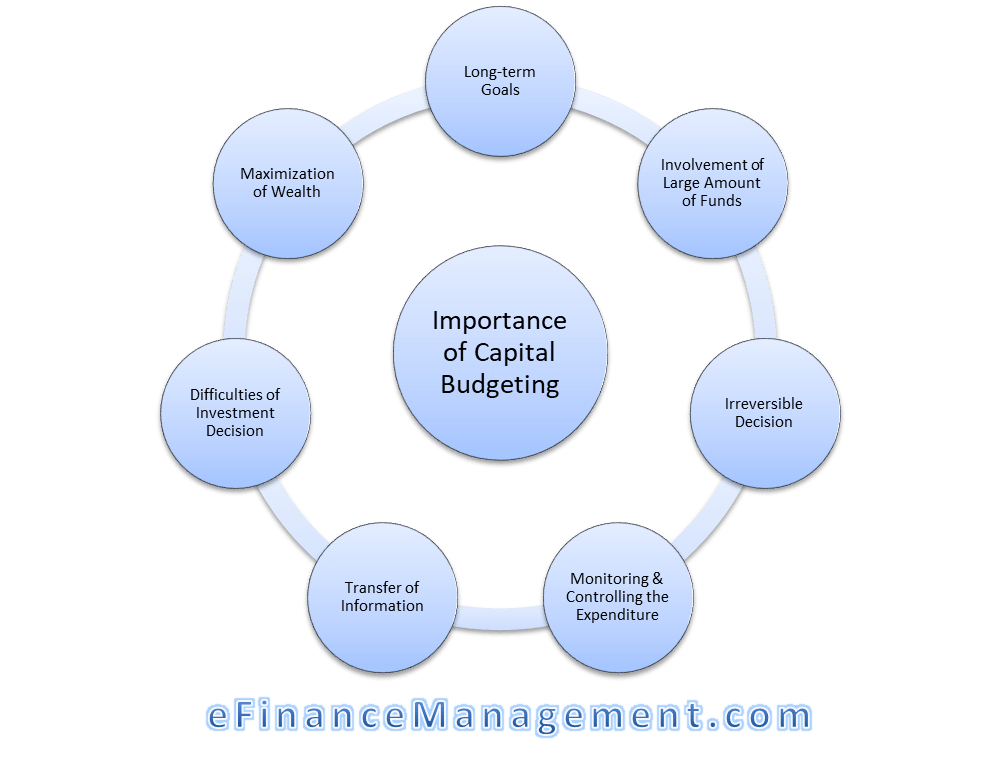

3152016 6 Importance of Capital Budgeting Benefits of Capital Budgeting Decision. Construction of a new plant or a big investment in an outside venture are examples of. Often they represent options available to an organisationbuy versus build or develop.

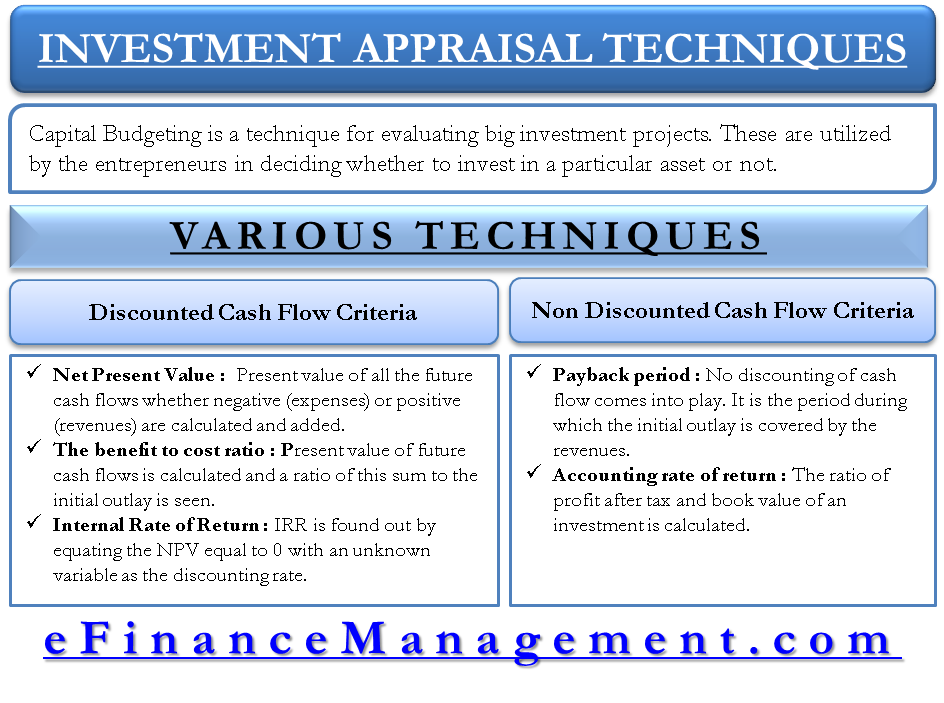

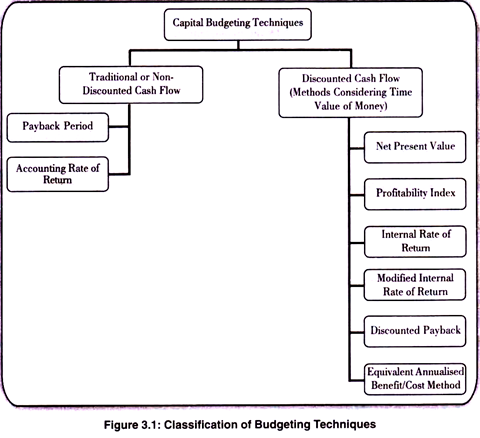

What is capital budgeting. Their biggest disadvantage is that they ignore the time value of money. Capital Budgeting decisions evaluate a proposed project to forecast return from the project and determine whether return from the Project is adequate.

Q4 Define dividend policy. Capital budgeting requires detailed financial analysis including estimating the rate of return for a capital project. Critically examine the various methods of evaluation.

The result is intended to be a high return on invested funds. Includes unit cost estimates for new construction and renovation based on GSF. Capital budgeting is concerned with choices among projects belonging to this category and these decisions are based on forecasts of individual project cost and returns.

Financial evaluations of capital expenditures and other long-term investments are very similar to evaluations of acquisitions. Capital budgeting is the process a business undertakes to evaluate potential major projects or investments. F irst capital budgeting is very important for corporations.

For instance a company may choose to value its projects based on the internal rate of return. The three most common approaches to project selection are payback period PB internal. It is a ratio of the average after tax profit divided by the average investment.

There are two broad evaluation methods for a capital budgeting proposal. A capital project request form must be filled out for each project and the following questions must be answered to evaluate the project. Details budget estimate for new construction area and renovation areas unit costs special scope items and considerations bid date and escalation project overhead percentages.

A narrative for each project included in the budget is required to justify the request for a certain budget of a city or state. Thus the manager has to choose a project that gives a rate of return more than the cost financing such a project. This is a fundamental area of knowledge for fi nancial analysts for many reasons.

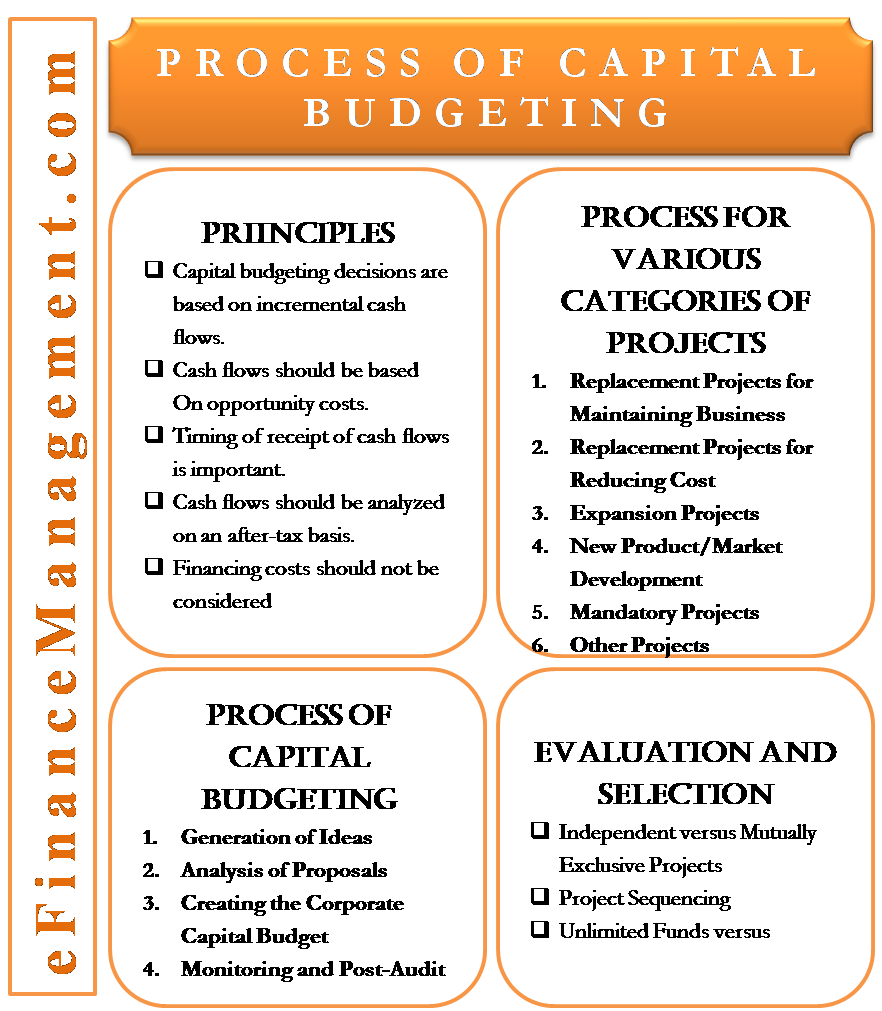

These are the traditional methods and include payback period and the accounting rate of return ARR. This is where capital budgeting comes in. Capital projects which make up.

They involve resource allocation particularly for the production of future goods and services and the determination of cash out-flows and cash-inflows. Both require addressing unknowns as well as specific management skills. As per this method the capital investment proposals are judged on the basis of their relative profitability.

There are three general methods for deciding which proposed projects should be ranked higher than other projects which are in declining order of. Non-Discounted Cash Flow Methods. Whether such investments are judged worthwhile depends on the approach that the company uses to evaluate them.

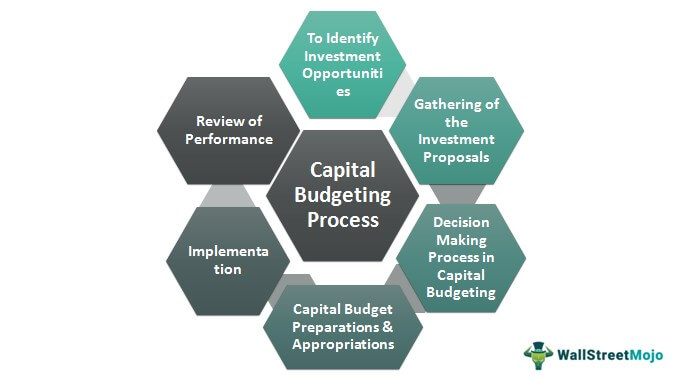

Capital budgeting is the process of making investment decisions in long term assets. The Capital Budgeting process is the process of planning which is used to evaluate the potential investments or expenditures whose amount is significant. Worksheet to record capital project budget estimates for capital projects of all types sizes and funding sources.

However there are few key differences. Refer to capital investment or expenditure decisions as capital budgeting decisions. It therefore depends on expectations of future sales.

Constructing A Capital Budget Ag Decision Maker

Constructing A Capital Budget Ag Decision Maker

Capital Budgeting What Is A Capital Budgeting Fincash

What Is Capital Budgeting And Its Process Of Calculation Tally Solutions

Capital Budgeting 5 Investment Appraisal Techniques Npv Irr Pbp Etc

Capital Budgeting Authorstream

Evaluating Capital Budgeting Decisions 8 Techniques Financial Management

Importance Of Capital Budgeting Meaning Importance

Capital Budgeting Process Top 6 Steps In Capital Budgeting Examples

0 Response to "20+ What Is Capital Budget Proposal Evaluation"

Posting Komentar